They say, “never borrow from your 401K”. Here is what happens when you do. Lets say you borrow $30,000 from your 401K. You’re borrowing pre-tax money so you don’t have to pay taxes on it when you borrow. However you have to pay it back with post-tax money. If you’re in the 25% tax bracket, you have to make $40,000 pre-tax to pay back the $30,000 loan into your pre-tax account. Note, for simplicity, I’m ignoring the 3.25% interest you have to pay yourself when paying back a 401K loan. By having to pay $40,000 to pay back the $30,000 you just borrowed, you’ve just been taxed $10,000 for that money. Now lets fast forward 10 or 30 years to when you retire early at 59.5 years of age. Now you can withdraw from your 401K without penalty. Lets say you need an additional $30,000 above your other income sources to cover your annual expenses. Your 401K is a pre-tax account, so to get $30,000 to pay your annual expenses you will need to withdraw $40,000 from your 401K. You will once again be taxed $10,000 on the money you withdraw, assuming you’re still in the 25% tax bracket. You’ve just been double taxed!!!

If you bought a depreciating asset with your 401K loan, like a car, you’d probably be kicking yourself right about now for paying all those taxes. But what if you invested the $30,000 401K loan into an appreciating asset?

The Case For Borrowing From Your 401K

It was the fall of 2010. The real estate market was hitting rock bottom in Denver, CO. I knew the real estate market would be recovering soon. The stock market had started the recovery a year and a half earlier and jobs were flowing into the Denver area. I was on the look-out to buy a multi-family property. I found a triplex that was being sold as a short sale for $190,000. Two of the three units were occupied, the third was vacant. Market rent at the time was $2400 per month with all 3 units filled ($800/unit). Monthly expenses were going to be about $1200/month, not including maintenance expenses. I wanted to get my offer in as quickly as possible so I submitted an offer sight unseen. The next day I walked through the property. It had a good amount of deferred maintenance, but nothing I couldn’t handle. The offer was accepted the next day. There was just one problem. I didn’t have the 25% down payment required to get a loan on the property. Would I do what all the experts told me not to do and take out a 401K loan? Of course I did! After a $30,000 401K loan and six months of waiting for the short sale, I closed on the property in the spring of 2011.

Here was my justification for taking out a 401K loan. First, I couldn’t have bought the property without it. I needed about $50,000 to close on the property. I already had about $20,000, but needed another $30,000. But that alone is no reason to take out a 401K loan and get double taxed! I had to look at the return on investment that the property would provide and ask myself if the double taxation on the 401K loan was worth it. I figured maintenance would be about $400/month. I had to pay for water and trash service and the plan was to slowly repair the deferred maintenance over time. I was expecting cash flow to be about $800/month once I got the third unit filled. I was expecting the return on investment from the cash flow to be 9600/50000 = 19.2%. In addition, monthly principal payments (which were being paid for by my tenants!) were adding to that return. I also expected the value of the property to increase, since the housing market was starting its recovery. I decided that all these benefits outweighed the double taxation penalty of a 401K loan.

Even though the tenants were paying down the mortgage for me and I expected the property to appreciate over time, I wouldn’t have bought the property if it didn’t have solid cash flow numbers from the beginning. That’s one of the lessons I’ve learned as a real estate investor, buy properties on cash flow, not the hopes and dreams of future appreciation.

How Did It Turn Out?

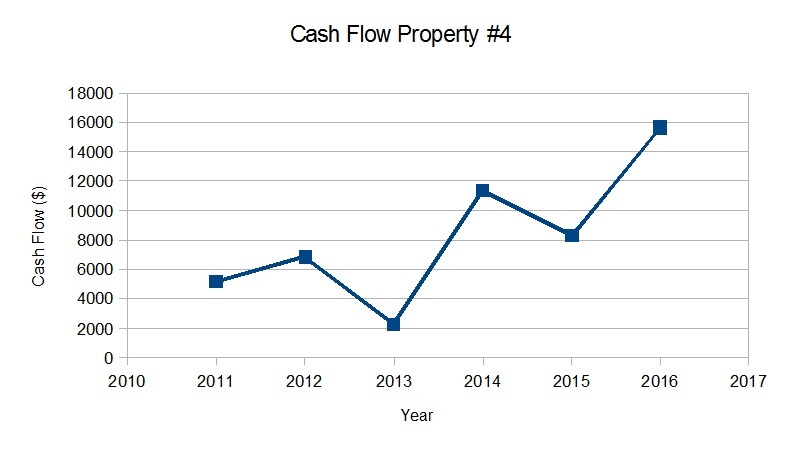

Maintenance expenses turned out to be higher than expected, but check out the cash flow from operations over the past 6 years in the chart below (net cash flow after all expenses and taxes). In the year 2013 there were some unexpected expenses; I had to replace 2 furnaces, I decided to replace the gutter, and one of the tenants moved out so I did a $7,000 rehab on that unit. Its nice that after all of that, the property was still cash flow positive for the year. My return on investment over the first 3 years averaged 9.5%.

By 2013, the Denver real estate market started to catch fire and rents were on the rise. Maintenance expenses continued to stay relatively constant, however rents went up significantly. My return on investment jumped to an average of 23.5% over the past 3 years and should continue at that level for years to come. The average return on investment from cash flow over the 6 year period is 14.75%. Cumulative cash flow from operations after six years of ownership is nearly $50,000. Meanwhile, the S&P 500 has averaged 7.72% from the time I bought the triplex to today.

In addition, monthly pay down of principal (paid for by the tenants) is approximately $25,000 over the 6 years.

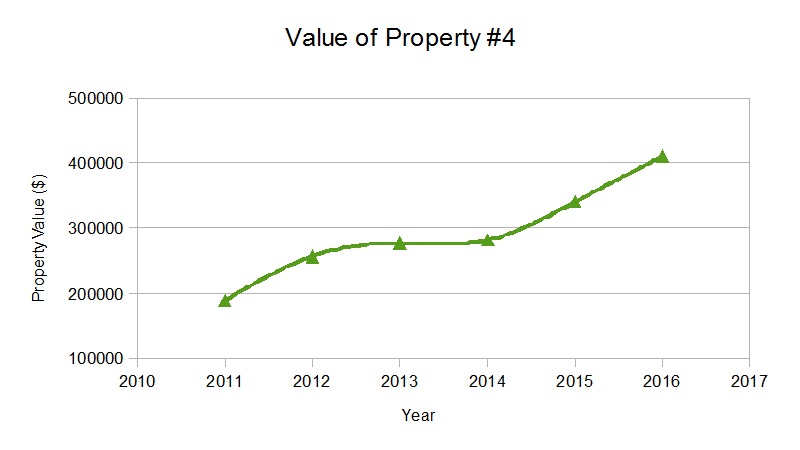

But wait, there’s more! Let’s not forget price appreciation. Check out the chart below.

I bought the triplex for approximately $190,000 in 2011. According to Zillow it’s worth about $410,000 at the end of 2016. Honestly, I think that’s a low estimate, but lets go with it. That puts the equity gain at $220,000 before taxes, or about $165,000 after sales commission and taxes if I sold the property today.

Was It Worth It?

To date, I’ve gained $50,000 from cash flow, $25,000 from debt pay down and $165,000 equity growth for a total gain of $240,000 after taxes and all other expenses if I were to sell the property today. All of this was enabled by my puny $30,000 401K loan combined with $20,000 cash that I already had. Sometimes its smart to borrow from your 401K.

Great read! I like the way you kept such good track of your gains and expenses so you were able to chart it for us. Something I should start doing too. Loved the article!